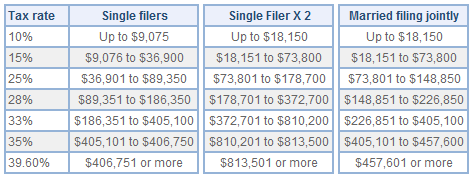

In Addition to basic Income Tax as discussed above, Followings are also to be taken care of:. 400 croreĪlso, the Government introduced special tax rates for domestic companies under various sections, these can be summarized as:- Domestic Companyġ. Where its total turnover or gross receipt during the previous year 2019-20 does not exceed Rs. Where its total turnover or gross receipt during the previous year 2018-19 does not exceed Rs. In case of a Domestic Company: - Domestic Company Certain income tax exemptions and deductions like section 80C, 80D,80TTB, HRA etc are available in the OLD tax regime but will not be available under the new tax regime. Health & Education Cess Rebate u/s 87A (no tax will be payable on total income upto Rs.5 lakh in both regimes)Ģ. Tax filers will need the 2021 federal income tax brackets when they file taxes in 2022. Joint filers will have a 25,100 deduction and heads of household get 18,800. Surcharge: Surcharge is levied on the amount of income-tax at following rates if total income of an assessee exceeds specified limits:- For the most recent taxes filed, for the 2021 tax year, the standard deduction was 12,550 for single filers and married filers who file separately. Individuals with age 60years or more but less than 80 yearsġ. Individuals with age less than 60 years or HUF It also increased the maximum child tax credit from $1,000 per child to $2,000 per child and modified some of the individual tax brackets.If Person is Resident Individual or HUF: - Income of the assessee The 2017 tax law increased the standard deduction for married couples from $12,000 in 2017 to $24,000 in 2018 (the standard deduction is tied to inflation, so it increased to $24,800 in 2020) and eliminated the personal exemption, which reduced taxable income by $4,050 per family member in 2017. Note that this example reflects tax changes made by the 2017 tax law, which are set to expire after 2025. Dividing that amount by the couple’s total income ($110,000) results in an effective tax rate of 6 percent. Our example couple is left with a final tax liability of $6,324. In our example, the couple can claim the Child Tax Credit for both children, further reducing their tax by $4,000. Taxpayers subtract their credits from the tax they would otherwise owe to determine their final tax liability. Credits directly reduce the amount of taxes a filer owes. The couple’s resulting tax liability - before credits are taken into account - is $10,324. Only the last $4,950 of their income faces their top marginal rate of 22 percent. The top marginal tax rate applies only to a portion of taxable income.Īs the graph shows, the first $19,750 of the couple’s taxable income is taxed at a 10 percent rate the next $60,500 is taxed at 12 percent. Subtracting that $24,800 from the couple’s $110,000 salary leaves them with $85,200 in taxable income - the amount of income subject to federal income taxes. In the example above, the couple can claim the standard deduction for tax year 2020 totaling $24,800. Because of deductions, not all income is subject to taxation. They face a top marginal tax rate of 22 percent, so they would commonly be referred to as “being in the 22 percent bracket.” But their average tax rate - the share of their salary that they pay in taxes - is only 6 percent, as explained below.Īn individual’s average tax rate tends to be much lower than his or her marginal tax rate for three main reasons.ġ. Average Tax Rate Is Generally Much Lower Than Marginal RateĪs an example, the graph below shows a married couple with two children earning a combined salary of $110,000. For example, in 2020, the first portion of any taxpayer’s taxable income is taxed at a 10 percent rate, the next portion is taxed at a 12 percent rate, and so on, up to a top marginal rate of 37 percent. Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2021. It achieves this by applying higher marginal tax rates to higher levels of income. The federal income tax system is progressive, meaning that it imposes a higher average tax rate on higher-income people than on lower-income people. Under a Progressive Tax System, Marginal Rates Rise With Income

0 kommentar(er)

0 kommentar(er)